Digital identity is the backbone of today’s electronic access control and authorization procedures. It comprises multiple elements that, when combined, enable businesses to verify that a user represents an authorized individual. Understanding the importance of digital identity and its management is essential for businesses today.

In 2024 alone, organizations conducted well over 70 billion identity verification actions—a 16% increase from the previous year. This surge reflects the growing demand for secure digital identity solutions. The industry supporting identity verification is now valued at $36 billion, with projections suggesting an exceptional leap to $154 billion by 2032.

Serious security or financial risks may develop without a thoughtful approach incorporating the latest technology and best practices. That’s not to mention the degraded user experience individuals have when they struggle to connect with you in cyberspace. It’s clear that appropriate solutions are a necessity and that many companies continue to accelerate the adoption of new solutions.

This article explores the digital identity management process and considers some digital identity management solutions and strategies. We’ll also touch on regulations that impact online identities, what the future of this space may hold, and how you can quickly improve your approach.

Table of Contents

- What are the four steps of digital identity management?

- An overview of the regulatory landscape

- Make identity-management user-centric

- Tools for secure digital identity management

- The growing interest in passwordless authentication

- The intersection of artificial intelligence and digital identity

- Digital identity integration with other technologies

- How Telesign solutions can help

- Explore more robust digital identity management

What are the four steps of digital identity management?

Understanding a digital identity is one thing, but managing the digital identity process is another layer to consider. There are four main elements to managing these identities in online environments. Let’s consider each one briefly.

- Provisioning

Provisioning involves creating or managing digital identities, ensuring a frictionless process for users. This step also includes securely collecting and associating data, enabling account setup and removal during events like cancellations or transitions.

- Authentication

Authentication confirms that a user claiming a specific identity has access rights. Common methods include one-time passwords, passkeys, biometrics such as fingerprint or facial recognition.

- Authorization

Authorization dictates a user’s access level. For instance, a shopper’s access is limited to their account, while staff might access backend systems. Clear, well-defined permission levels ensure security and operational efficiency.

- Lifecycle management

Any organization must have good insight and substantial control over the digital identities it manages. Lifecycle management tracks digital identities from creation through deactivation, including onboarding and offboarding processes. Effective management ensures individuals lose access when their association with the organization ends.

Robust solutions to address all four steps are essential to secure and efficient identity management.

An overview of the regulatory landscape

In years past, managing a digital identity was primarily a matter of logistics and security. Today, new regulations around the world have complicated that landscape. Consumers and computer users in some areas now have broader rights to exercise over the digital information collected and used by businesses. Likewise, those businesses now have additional regulatory concerns to confront. Here are some notable laws and guidelines relevant to digital identity management.

General Data Protection Regulation

Under the General Data Protection Regulation (GDPR), individuals in the European Union are granted expanded rights to control the personal data collected by businesses. These rights include the ability to request access to all the information a company has collected about them and, in certain circumstances, the “right to be forgotten”, allowing users to request the deletion of their personal data. The GDPR also mandates that businesses collect only the minimum amount of information necessary to provide their services. Non-compliance with these regulations can result in significant penalties.

California Consumer Privacy Act

The California Consumer Privacy Act (CCPA) similarly enhances user’s control over the personal information businesses collect. It grants users the right to know what information is being collected, and like the GDPR, the right to request its deletion of that data. Additionally, users must be given the opportunity to opt out of the sale of their data, and companies are prohibited from retaliating against users who exercise these rights.

National Institute of Standards and Technology

The National Institute of Standards and Technology (NIST) has also weighed in on the issue of digital identity. Following two rounds of public comment on its proposed guidance, first in 2023 and then in 2024, the agency continues to finalize its recommendations. With Digital Identity Guidelines, NIST aims to establish uniform standards for identity verification methods used across the web.

The latest draft includes new guidance based on public feedback and touches on technologies such as passkeys (or syncable authenticators) and identity wallets controlled by users. Controls for facial recognition and other biometrics are also a part of the draft document.

Recognizing that some users may prefer traditional methods, NIST plans to include provisions for maintaining access through conventional identification methods. Organizations are advised to closely monitor the progress of this initiative as NIST moves towards finalized guidance.

Basic best practices for compliance

There are several steps that a business may take to strengthen its compliance stance as it relates to laws such as the GDPR and CCPA. Some of these steps include:

- Collect only the data necessary to provide the services and support required by users.

- Adhere to the principles of least privilege, ensuring users have only the level of authorization necessary for their specific tasks.

- Maintain transparency about what data you collect, where it is stored, and how it can be retrieved.

- Clearly define the purpose behind the data you collect.

- Appoint appropriate personnel, such as data protection officers, in regions governed by regulations like the GDPR.

For a comprehensive understanding of your legal obligations, consult a lawyer with expertise in data privacy and regulatory compliance.

Make identity-management user-centric

In a more complex regulatory environment and at a time when users care more about how organizations handle their data, it’s vital to focus on empowering users. Making users central to identity management can improve privacy and security and enhance user satisfaction. There are some emergent strategies to make this process more user-centric.

Enable users to see and understand the data you collect and how it relates to identity management. Users should have as much control over what defines their identity online as possible. Err on the side of caution and ask users for consent to access data-related operations routinely. When a user needs to authenticate, provide more options for how an individual can do so. New technologies, which include blockchain and the Internet of Things (IoT), may accelerate this transition and the move towards a self-sovereign identity (SSI).

What is a self-sovereign identity?

A self-sovereign Identity (SSI) enhances security and trust in identity verification. It leverages advanced cryptography, secure communication channels, and the unalterable digital record provided by blockchain technology. Under an SSI framework, the individual maintains full control over their identity and its components. An SSI wallet may contain digital representations of a driver’s license, account logins, and more. The SSI system operates on a “triangle of trust” involving issuers, users, and verifiers.

An issuer is an organization that provides a valid means of identification, such as a state government issuing a driver’s license. An issuer could be any other organization that generates a secure digital version of an identity credential. The user retains full control over these verifiable credentials within their wallet.

When users need to identify and verify themselves, they can choose exactly what information they want to share from their wallet. The verifier does not receive the actual data; instead, they are provided with cryptographic keys linked to a permanent blockchain record. Verifiers to confirm that the presented keys match the records without ever accessing the original secured information.

While this explanation simplifies a highly complex and still-evolving technology, interest in SSI remains high for several compelling reasons. Users maintain control over their data, which is imperative in today’s threat environment. Finally, it will also allow for a faster, more frictionless web verification experience. Stronger, smarter, and faster: these are why SSI continues to attract attention and investment.

Don’t overlook the importance of user experience and strong UX design in these current and future applications. A seamless, professional experience in the login or authentication process helps build trust in a system’s security and reliability—clear indications about your efforts to protect privacy also matter. Users may be more likely to engage when the identity verification process involves less friction.

Tools for secure digital identity management

How do you effectively administer a system of digital identities? Identity and access management (IAM) solutions are the answer. Many modern tools exist to support fraud and identity management across the web. Platforms provide different levels of functionality and compliance support. Some allow for comprehensive solutions, while others offer piecemeal elements to support more custom development. Some notable, modern IAM standards include those listed here.

- OpenID Connect: a protocol built on a standardized framework for user identity verification and system authorization, enabling customizable sign-in workflows.

- Oauth, or Open Authorization: a token-based access system that simplifies sign-ons across multiple applications or websites.

- Security Assertion Markup Language (SAML): a standardized protocol that facilitates single sign-on capabilities across the web.

Broader platforms, especially those that function as SaaS deployments, use these standards to facilitate connections and streamline management.

The growing interest in passwordless authentication

While the development of SSI applications continues, other authentication methods continue to mature and gain broader acceptance among the public and in commerce. Passwords have typically been the weakest link in the digital identity chain, vulnerable to compromise by malicious actors. Once a password is exposed, the only remedy is to replace it, often with another equally vulnerable one. For years, organizations have struggled to encourage users to create strong passwords, yet significant challenges persist.

These problems explain the increase in interest in passwordless authentication. Currently, two approaches are in use today: passkeys and biometric authentication, both of which continue to gain traction.

What are passkeys, and how are they different from passwords? Passkeys are meant to replace passwords entirely and apply the well-established technology behind public/private key cryptography. After a user accesses a site using a traditional log-in method, they may have the option to create a passkey. The site retains a record of their portion of the key pair while the user stores the passkey on their device.

Biometric authentication (such as a smartphone verification of an individual’s face or fingerprint) can provide the certainty required to grant users access and enable them to submit their passkeys. In some cases, this biometric data serves as the sole means of accessing certain elements of an individual’s digital identity. However, privacy concerns surrounding biometrics and the potential for serious identity theft add a layer of complexity, prompting ongoing research and development efforts.

Passkeys and biometrics confirm that you are who you claim to be—and that you (and only you) are the one requesting access. Together, these technologies can eliminate the need to remember passwords while creating a stronger, more secure digital environment that shares less personal and private information.

The intersection of artificial intelligence and digital identity

It’s no secret that interest in artificial intelligence and machine learning technologies is at an all-time high. Investments and development continue at a rapid pace. What kind of AI-related impacts might we see on digital identities?

Perhaps the most likely role now and in the future is the application of AI to biometric authentication. As we’ve seen, biometrics play a central role in the distribution of passkeys and the future of self-sovereign identities. Machine learning models and AI algorithms can rapidly and accurately verify matches for physical features such as fingerprints, facial prints or even an individual’s voice. AI also aids in positive identification under suboptimal conditions, such as low lighting, odd angles or other challenges.

AI that runs behind the scenes can also support smarter multi-factor authentication. It is much simpler and far faster for an AI model to analyze a broad range of identity signals and digital interaction patterns for potential signs of fraud.

A sophisticated hacker might be able to bypass some layers of security, but an AI detector could flag suspicious activity that deviates from expected behavior. This would make it easier to put a stop to any intrusion attempts. The same “red flag” system could be applied to real-time user sessions. If behaviors change substantially from expected patterns, the AI might require additional steps or re-authentication.

As AI models continue through the refinement process, we can expect to see this technology play a central role today and in the future.

Digital identity integration with other technologies

Digital identity management strategies must account for changes in technology and the emergence of new tools. Several considerations in this area are essential to companies today. What are they?

- Blockchain

Blockchain technology is most famous for its ties to cryptocurrency, but the concept of decentralized ledgers has many other more valuable applications. A blockchain could soon become a means of Decentralized Digital Identity (DDID). In a DDID system, each business or brand might not be directly responsible for managing one’s identity. Users retain complete control over their data and what they disclose.

The blockchain records transactions permanently, simplifying the process of seeing who has access to what you’ve shared. Theoretically, greater security and flexibility are available, and there is no need for central management authority. As discussed above, blockchain technology will be central to the future of digital identity management. Such platforms are vital for implementing SSI solutions. With a permanent, unchangeable record, verifiers can confirm that an individual’s issued credentials remain consistent without any evidence of interference.

- Internet of Things

Digital identity doesn’t only refer to real people who want to take action online. Devices have an identity too. IoT devices often need to connect to systems independently in the vast marketplace of web-enabled technology. Authentication and authorization are important even when a device makes the request. Typically, these processes have not proven to be strong or reliable. Such weaknesses in security have led to data breaches, ransomware attacks, and more.

As we look to the future, better authentication solutions in the IoT environment will be necessary. Decentralized identities, again possibly powered by blockchain technology, could be the answer. Other services currently exist to support centralized identity provisioning using a more traditional approach.

- Future trends

We’ve covered many of the emergent trends in the digital identity space today, such as passkeys and biometrics, self-sovereign or decentralized identity, and the rise of AI. What else might the future have in store? While no one can predict what comes next with absolute certainty, some new ideas have already circulated.

First, expect to see more interest and exploration in the concept of zero-trust security. Under such a framework, no one — neither users nor their devices — receives an inherent level of trust. Zero-trust architectures rely on stronger and more frequent authentication to ensure that only authorized users can access resources. This approach is central to the SSI and passkey movements.

Second, we anticipate that more biometric authentication will emerge. Regulatory and compliance concerns may hamper such rollouts at first. However, the convenience and reliability they offer to users make biometrics an essential part of future digital identity management strategies.

Third, cloud-based solutions may increase to facilitate easier access across diverse digital environments. In an economy still seeing a significant amount of remote and hybrid work, there is a greater need to secure and manage cloud access. To keep workers connected in this environment, smarter and more secure approaches will have to play a role.

How Telesign solutions can help

In today’s complex landscape, finding the right solutions can save time and money, reduce stress, and deliver a better experience for end users. At Telesign, we’ve developed a suite of solutions designed to enhance secure digital identity verification, combat fraud, and streamline identity management. These solutions strengthen your company’s security stance while creating opportunities to improve user satisfaction and engagement. Here, we’ll review three solutions best suited to these workflows.

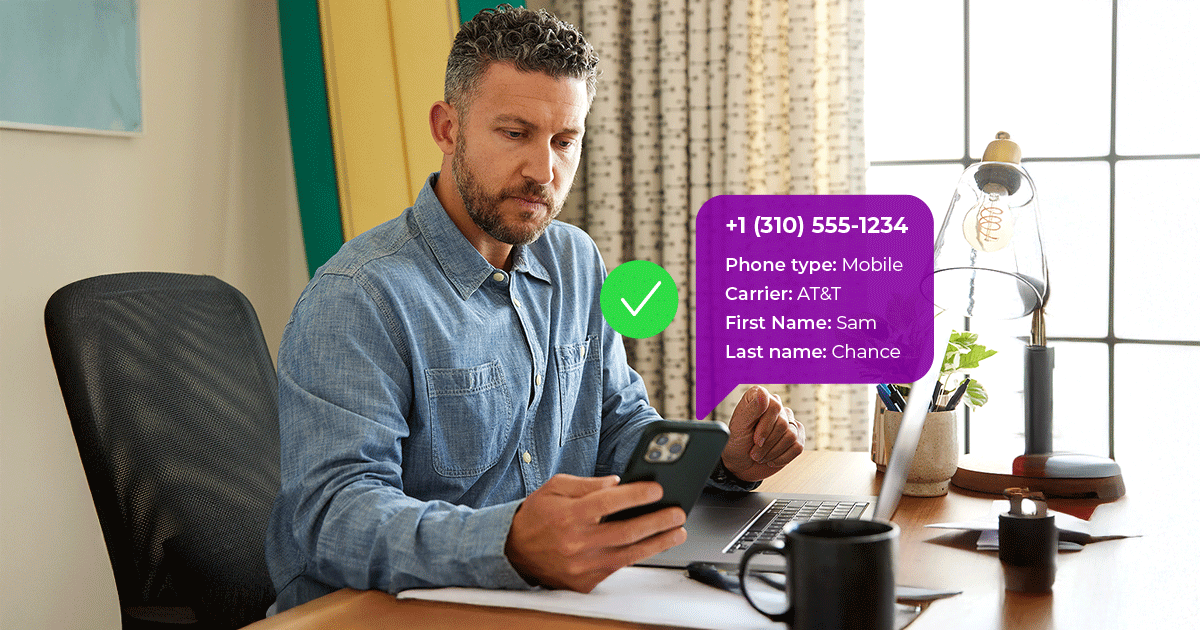

Phone ID simplifies verification by leveraging one of the world’s largest databases of mobile identity information. It supports improved message delivery rates. By using a combination of static and behavioral attributes to analyze identities. This process enables you to verify critical details, such as a user’s name and address, ensuring they are who they claim to be.

Intelligence can help combat fraud and minimize risks. Intelligence can create risk recommendations and scores for each user interaction with your ecosystem and raise red flags when potential fraud occurs. By using Intelligence’s adaptive machine learning, you can reduce digital identity theft risks in real time. Over time, as the system processes more data, its fraud detection capabilities become increasingly sophisticated, offering a robust defense against digital identity theft.

Verify API secures digital identities through a user-friendly omnichannel experience. No matter where users meet your brand, whether it’s via a mobile device on the web, a desktop computer, or even an app, omnichannel integration leads to seamless movement across digital spaces. Verify API supports authentication via many channels, including WhatsApp, RCS, push notifications, SMS verification and more. It’s a simple but powerful tool for improving sign-up processes, user onboarding, and transaction verification.

When login and authentication procedures are as fast and easy as possible, users appreciate it. There may even be an increased expectation for portability and ease of access among modern users. Dozens of different identities across different platforms isn’t a good experience.

Consumers prefer omnichannel experiences, which also keep users more engaged. It’s a simple way to boost satisfaction while you foster the conditions for more time on site and the potential for extra sales. With Telesign solutions, you can access innovative new ways to manage this mission-critical process that benefits both the business and its users.

Explore more robust digital identity management

A robust digital identity strategy isn’t optional today—it’s essential. The right approach not only helps protect your business and its customers but it can also deliver a seamless, enjoyable user experience. Omnichannel support and user-centric design create a smarter, stronger approach to today’s fundamental digital security elements.

Simplify management and provide a faster, more reliable experience for users interacting with your brand online. Chat with the Telesign team today for more information about how modern platforms and technology change the game to simplify security and compliance.